Laddering gives you

the power to change

your coverage

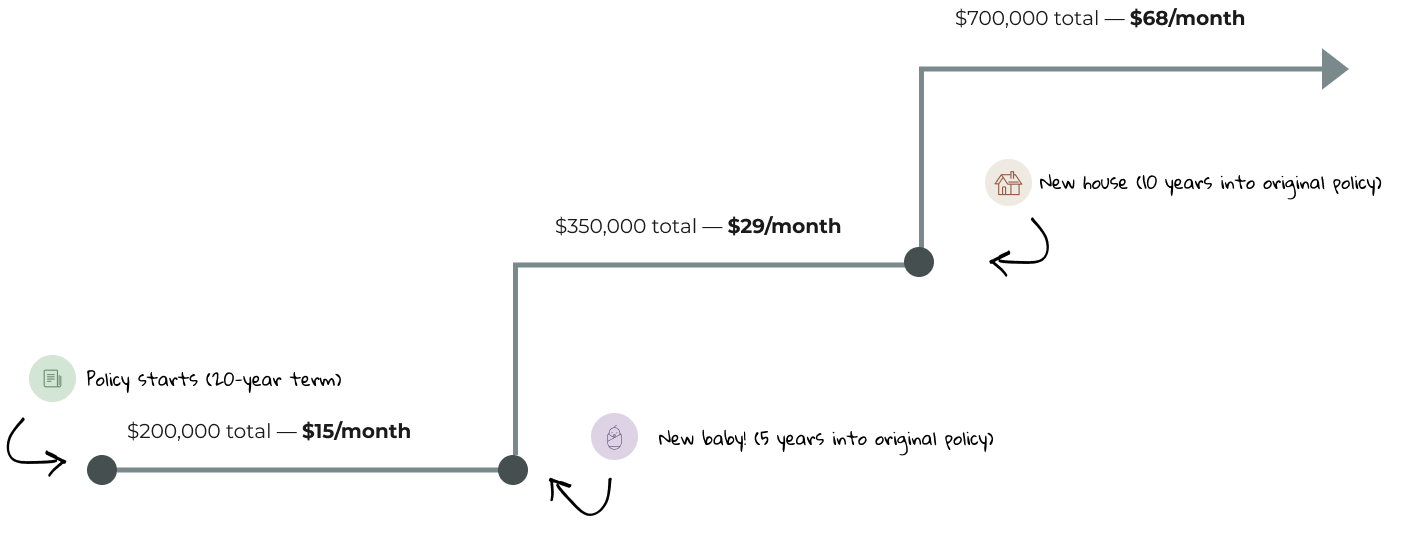

What is Laddering?

Laddering is a tool that lets you adjust your coverage, up or down, whenever. People say it sets us apart—and they love how, with Ladder, their coverage can match their needs. Use it often or not at all, it’s entirely up to you.

Some opportunities to “Ladder down”

The upside of “Laddering down”

Your monthly payment lowers, which could lead to substantial savings over time

You don't pay for more coverage than you actually need

It's fast and easy to do

$3,628

total savings

Based on a 28-year-old female in good health. Preferred plus. Prices vary. Not all prices will be reduced proportionally.

Total savings over 0 years

$0

Let's see if you're instantly approved for in coverage at a -year term.

See how much you could save by Laddering down* once a year

Coverage

Term

Monthly premium

*Savings in premium compared with the same client maintaining their full coverage amount for the policy term.

Savings attained by decreasing coverage to the next available lower face value every subsequent year from policy issue date. Prices valid as of February 18, 2021.

The upside of “Laddering up”

It’s easy to apply for more coverage

It’s fast—we autofill as much of your info as possible

Answers to a few good questions

Ready to get started?

Find out today if you're instantly approved for coverage