How Ladder’s Dynamic Life Insurance Can Save You Money

The most important thing you can do when it comes to life insurance is get basic coverage squared away quickly. What you start out with doesn’t have to be perfect, or a lot of coverage. But if something unexpected happens to you, your foresight can ensure your loved ones have some financial support in their time of need.

After your initial coverage is in place, adjusting it over time can be a smart financial move because it allows you to best support your dependents and ensures the wisest use of your money. Life is dynamic, so your life insurance should be too. Your income and savings will go up (hopefully), mortgages will get paid off or increase, families grow and children will become independent. When these milestones happen, adjusting your life insurance to complement your changing coverage needs can provide you with a great financial hedge against loss of income and changes in responsibility — and could save you a significant amount of money.

Historically, term life policies have often been fixed, regardless of what you need to cover. If you were allowed to make changes, it took a long time — and in many cases penalties and fees applied. Customers found this time-consuming and frustrating, so they often gave up, leaving money on the table. But today, there is a better way to manage your policy — a way that gives you more flexibility, avoids lengthy approval delays and costly fees and gets you coverage that is tailored to your needs. Let us tell you about Ladder.

At Ladder, we want to help customers win.

Here at Ladder, we think of life insurance from the customer’s point of view. Life is dynamic, so we designed life insurance that’s dynamic too. “Laddering” is how we give customers control over their coverage and costs over time. If customers want to increase coverage, they are “laddering up”, and if they want to decrease it, they are “laddering down”.

As coverage goes up or down, what customers pay can go up or down as well. Ladder has made it easy to apply for more coverage, or to reduce coverage, at the touch of a button and with no extra fees, putting the customer back in control.

To understand it in action, here are two examples to illustrate how laddering saves money over time:

Ladder up to easily increase coverage

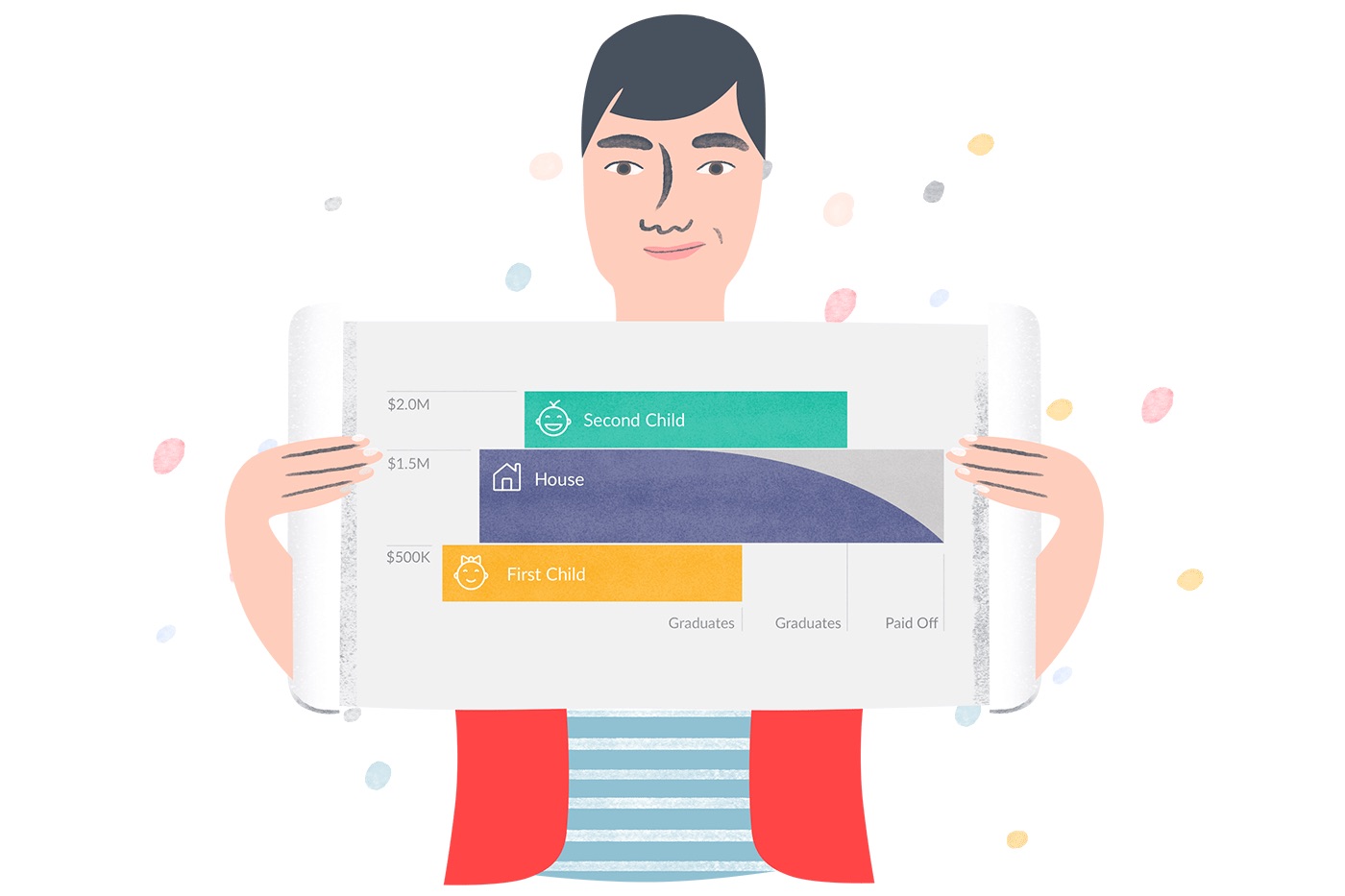

Meet Oliver, a healthy 34 year old software engineer living in San Francisco. After the birth of his first child, Oliver gets life insurance in place for the first time using Ladder. It takes him 5 minutes to get it done, and he gets $500,000 of coverage for 20 years at just $21.54 a month.

A year later, he and his family move from their one-bedroom apartment into a home. Oliver gets a 30 year mortgage for $1 million dollars. To cover that debt, he applies to increase his life insurance coverage by $1 million and ladders up at an additional cost of $69.06 a month.

With the birth of a second child a year later, Oliver applies to ladder up again with another $500,000 of coverage for 20 years. Being two years older than when he bought his first life insurance (but still in great health), Oliver’s price for this slice increases a bit, by an additional $23.19 a month.

Now, he has $2 million in coverage that reflects his family’s needs, but got the best pricing, buying more only when he needed it.

Ladder down to save money

Now, for the laddering down part. As Oliver pays down his mortgage over time, he can ladder down on his Ladder account page to instantly decrease his coverage, and his payment, at no cost. Laddering down means that his payments reduce by the same % as his coverage – so, for example, if coverage goes down by 10%, his monthly payment goes down 10% too.

In fact, if Oliver ladders down the $1 million of life insurance coverage each month by the same % that his mortgage principal decreases, he can save more than $10,000 over the term of his policy in lower insurance costs.* That’s a 40% savings compared with the total of $69.06 a month over 30 years.

Alternatively, if Oliver invests the amount he saved from laddering down each month, assuming an 8% rate of return, he can double his savings by the end of his term.

Optimizing your life insurance over time can be a smart way to manage your finances. Ladder’s dynamic life insurance enables you to be in control of your coverage so you are making the best use of your money.

How to get started?

The first step is to figure out how much coverage you actually need. You can do this easily with a simple (and fast) online calculator. Once you know how much coverage works for you, you can apply in minutes and get an instant decision. We think you’ll be surprised by how affordable life insurance can be. It only takes a few minutes to apply with Ladder, and you can finally check life insurance off your to-do list.

As your life evolves, and your financial needs change, you can apply for more coverage, reduce your coverage or cancel, whenever you like, at the touch of a button. There are no fees/penalties, mountains of paperwork or agent involvement.

If you have any additional questions, please feel free to contact us. Our goal is to make life insurance as easy as can be.

*Assumes a level mortgage payment and loan interest rate of 4% on a 30 year mortgage of $1 million. Savings of over $10,000 are calculated as the total of the difference between the level monthly life insurance payment and the laddered down life insurance payment each month. The laddered down life insurance payment is calculated each month by reducing the level monthly life insurance payment in proportion to the reduction in coverage that matches the reduction in the mortgage principal.